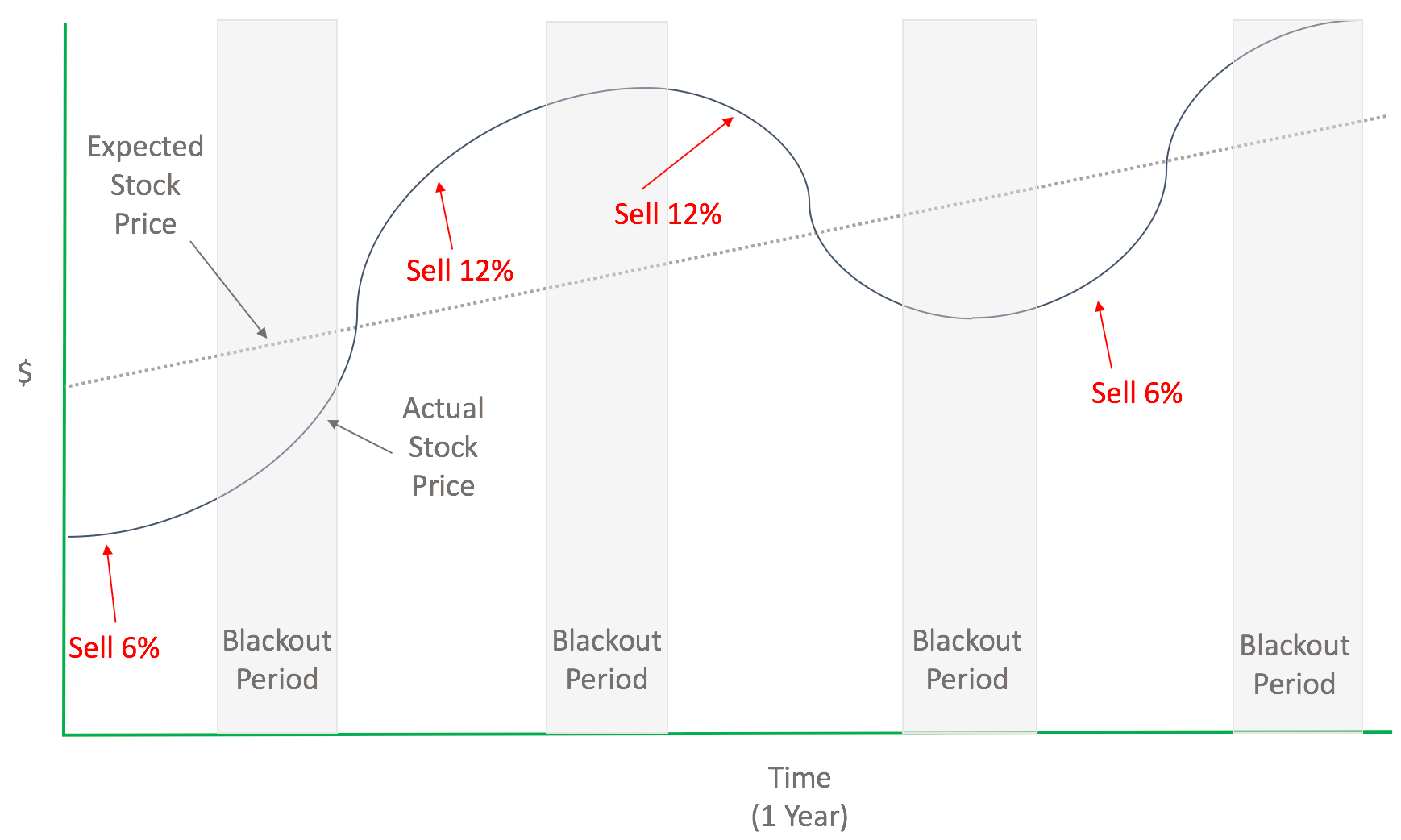

This week, I take a look at the process and timing of leaving a company when you have stock that remains to be vested.

Welcome.

RFG is the place to find practical, real world information on personal finance, real estate, investing, stock options and more.