My startup stock options calculator

Calculating the value of ISO stock options

If you follow me fairly regularly, then you know I feel there is a criminal lack of understanding about startup stock option compensation. With the rapid growth of technology and venture capital, stock compensation has become increasingly common. Unfortunately, most people know little to nothing about what an ISO stock option is, when to exercise them, when to sell them, or how they are taxed.

Worst of all? Many people don’t know how to value their options. All they know is that they received 1000 shares in their company (or potential future company). That sounds good… it’s better than 10, or 100… but just knowing the number of shares is completely meaningless. Those shares could be worth $.10 per share, or $1000 per share.

ISO startup stock options calculator

All that’s necessary to calculate the value of startup stock options is A) the number of shares in the grant and the current price per share or B) the number of shares in the grant, the total number of shares, and the total valuation of the company. The future value of the company is also important to guess. Plug those numbers into the calculator below (and read on…).

Keep in mind the quality of the information you put in is crucial to the quality of the info you get out - and no matter what it is an estimate. If you put crappy estimates in you get a crappy estimate.

All of this information, except for the potential future value, should be readily available to anyone who receives an ISO grant. That means that you should beware of any company that is unwilling to provide either the current price per share or the total shares outstanding so that the grant value can be calculated. This information is vital, and should not be withheld from a potential future employee.

How to keep track of the value of an ISO grant over time

Once the number of shares in the grant, the current price per share, and potential future value have been established, it’s important to keep track of the value of the shares over time, along with how many have vested at any current time. Most grants vest over a 48 month period, but the average tenure of an employee of a tech company is far less than that. This means that the total number of shares in a grant are almost meaningless: what is important is how many have vested at any particular time. In other words, it’s important to not count any chickens before they’ve hatched.

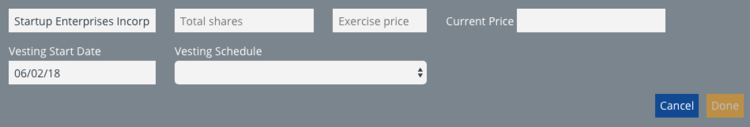

I use Personal Capital to keep track of all of my stock option grants over time. Their vesting schedule calculator just needs the core information about any individual grant, as shown below.

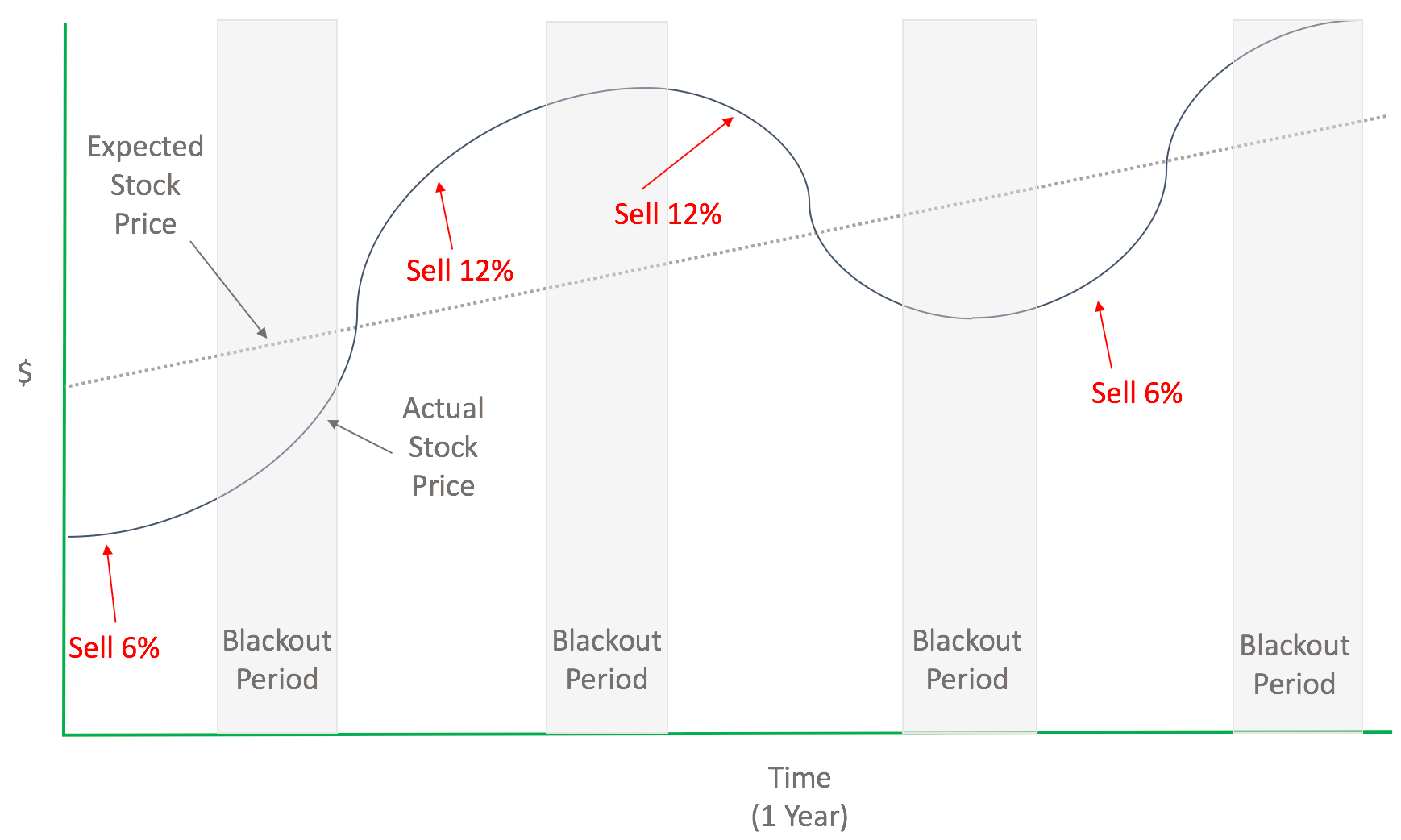

Once this information has been inputted, Personal Capital spits out a time series which shows the cumulative value of a grant, or set of grants over time. Of course. this is also visible in the overall net worth visualization on the home screen within Personal Capital.

Other important information to keep in mind

It’s easy to get overly excited about stock options, so there are some caveats I wanted to mention that help me keep an even keel as I consider the potential value of my options.

Most options expire worthless: Companies fail. People leave before their options vest. Sometimes, people are fired. Until an option is vested, its value is $0 and 0 cents.

Companies issue more shares: Just because there are only 10,000,000 shares now doesn’t mean that more won’t be created, diluting the value of every other share. Most companies will raise money 4-6 times before an IPO or purchase, meaning that the initial ownership stake of any ISO grant will likely decrease by 40-75%. Usually, the increased valuation that goes along with a funding round will offset this dilution, but it’s important to keep in mind.

The shares will not have value unless they can be sold: Keep in mind that it is nearly impossible to sell startup stock options unless the company is public, or it’s acquired. There are companies that intermediate transactions in private company stock, like Sharespost, but not all companies allow their stock to be sold in secondary transactions. Some companies will allow employees to sell shares during financing rounds (Uber and other late stage companies have done this), but it’s uncommon.

TAXES... remember taxes! Although ISO options are taxed at incredibly favorable rates if properly executed, they can be taxed at rates as high as income tax. I cannot stress enough how important it is to consider taxes when it comes to stock options.

Conclusion

There’s not too many things more exciting than landing a big stock option grant in a hot new startup. However, the potential future value of a grant hinges on many factors. Make sure to take all of them into account!